Few legislative battles conjure as much oppositional ire and passionate support as President Barack Obama’s Patient Protection and Affordable Care Act, known colloquially by dissenters and supporters alike as Obamacare. While the debate raged through much of 2009, lighting up Congress, town halls, water coolers and boardrooms across the country, the bill that eventually passed in the spring of 2010 represented the most significant health care overhaul since the passage of Medicare and Medicaid in 1965.

While the bill remains largely unpopular, garnering less than 50 percent approval nationally, polling on individual provisions within the bill enjoy widespread public support, particularly when it comes to issues like allowing young adults under age 26 to remain on their parent’s health plans (61 percent support), ensuring businesses with more than 50 workers supply their employees with insurance (72 percent) and ensuring that individual policy holders cannot be denied insurance for having pre-existing health conditions (82 percent).

While strong opposition remains, history reveals that support for the bill is likely to grow, as once reviled entitlement programs like Medicaid and Medicare now enjoy widespread support among voters of all political stripes. On the heels of Chief Justice John Robert’s majority Supreme Court decision to uphold the backbone of the bill—the government’s ability to enforce an individual mandate penalizing individuals who don’t purchase health insurance—the bill, or at least some incarnation of the legislation, is expected to stand the test of time and change the face of American health care forever.

The Bill

The year the Affordable Health Care Act (ACA) was passed, some of the most popular provisions of the bill went live, including small business tax credits for four million small businesses, allowing states to expand Medicaid roles, providing prescription drug donut hole rebates for seniors, expanding coverage for early retirees, providing insurance to Americans with pre-existing conditions and extending coverage for young adults under the age of 26. As a result of the new law, 123,000 young adults in Georgia have obtained insurance and 100,000 people have received prescription drug rebate checks.

By 2020, 35 million more Americans will be insured, and for the first time in American history, 95 percent of all non-elderly legal U.S. residents will have health insurance. Many of the most dramatic changes in the bill are not scheduled to come into play until 2014, when national insurance exchanges will provide affordable insurance at competitive rates, annual insurance limits will be eliminated, discriminations associated with gender and pre-existing conditions will lift, small business health insurance tax credits will increase and physicians will start to receive reimbursement based on value instead of volume. While many of these provisions will have positive effects on American patients, they place intense demands on medical insurance companies, health care providers and small businesses required to cover more employees.

Insurance Companies

The Affordable Care Act stipulates that insurance companies will no longer be able to rescind coverage of sick individuals based on an error or technical mistake, they will no longer be allowed to institute annual or lifetime insurance caps and adults and children with pre-existing conditions cannot be denied coverage. Additionally, unreasonable rate hikes will be prevented, consumers can appeal insurance company decisions and 85 percent of all premium dollars must be spent directly on care instead of advertising or administration.

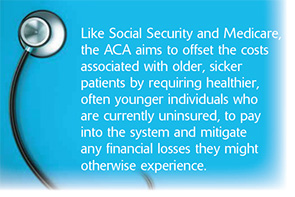

While many of these popular provisions would force for-profit insurance companies to operate in the red, the bill hopes to offset the financial losses of patient protections by collecting increased revenue as a result of the individual mandate. Like Social Security and Medicare, the ACA aims to offset the costs associated with older, sicker patients by requiring healthier, often younger individuals who are currently uninsured, to pay into the system and mitigate any financial losses they might otherwise experience.

Physicians

Often considered the public face of health care, few Americans will be more affected by the new health care legislation than doctors. Quantum Radiology, one of the largest radiology groups in Georgia, recognized the importance of the law when it was still just a whisper among Washington elite. “We got involved pretty early, before the act was even passed,” says Dr. Alan Zuckerman, president of Quantum Radiology, a 43-physician practice that operates out of WellStar Health System as well as several stand-alone imaging centers. “We took several trips to Capitol Hill and visited with several congressmen and senators and voiced our opinions about what should be in the bill, so even before the act was passed we had a pretty good idea of what would be in it.”

Whether someone visits an emergency room, is admitted for surgery or is examined for the presence of disease, radiologists are tasked with reading every patient film and diagnosing any internal pathologies or injuries. “What we realized early on is that whatever happened, more people would be coming into the system as patients and they are going to have insurance coverage,” says Zuckerman. “We certainly recognized the financial crunch. Health care costs are spiraling out of control and accounting for a greater and greater share of the gross domestic product, so to curb costs, the reimbursement per patient will decrease, which means doctors have to be more efficient.”

Quantum Radiology is looking to increase its efficiency by expediting services and buying supplies at a lower cost, but the real savings comes from reducing the number of exams per patient through the use of appropriateness criteria that determines exactly which scans are medically necessary. While they acknowledge that a streamlining process requires coordination with other physicians and assuaging fears of malpractice suits for scans that are not performed, such coordinated health care solutions are likely one of the most important ways of dampening costs in America’s ballooning medical landscape.

While Quantum Radiology experienced a mild increase in insurance expenses as a result of covering more employees and a new influx of dependents, such as adult children, the practice’s greatest challenges revolve around the bill’s attempts at cost control. “With the Affordable Care Act there are definitely examples of physicians being targeted,” says Zuckerman. “The CMS (Centers for Medicare and Medicaid) schedules reveal increasing downward pressure on reimbursement and there are increased taxes and fees on medical equipment manufacturers, which will be passed on to the consumer—in this case, hospitals and physicians.”

And while more patients with private insurance, Medicare and Medicaid coverage means an increase in revenue collection for services rendered, Zuckerman believes half the equation remains unsolved. “The No. 1 impact of the bill is an increase in the volume of patients with insurance, which presents a big issue. How do you bring extra patients into the system when there is already a doctor shortage?” says Zuckerman. “There will be an offset in revenue, but not an offset in time, so a doctor might be required to read 120 scans a day instead of the 100 he used to read.”

Health Care Systems

The nexus of the modern health care machine, the hospital system is the place where doctors, medical professionals, patients and administrators work together to form the microcosm that is modern medicine. One of the largest health care systems in Georgia, WellStar Health System has been at the forefront of monitoring the health care debate. “Even before the ACA was passed, there was a need to find better methods of population management,” says Jim Budzinski, executive vice president of WellStar Health System. “Finding new ways to serve ill and healthy populations and perform both preventive and curative medicine is all necessary for the future of medicine.”

As a company that offers insurance to all full-time and part-time employees, one of the most dramatic effects of the new legislation has been an increase in insurance costs for the average employee, both in terms of coverage expansion and an increase in dependents covered per insurance policy. “From an employer perspective, the impact of benefit cost increases for 11,000 employees amounts to roughly $1 million a year,” says Budzinski.

While WellStar remains a non-profit health system that pumps six pennies of every dollar back into reinvestments in equipment and facilities, the system likely will be required to absorb some of the costs passed on by medical device makers hit with increased taxes. “The bill also has significant Medicare reimbursement cuts tied to offsetting the cost of the expansion of Medicaid over the next 10 years,” says Budzinski, echoing some critics who forecast that nearly 15 percent of American hospitals could be forced into debt as a result of the funding cuts.

While the ACA also mandates health care savings through implementing electronic health records, WellStar is in the process of implementing WellStar Connect, a new software system expected to cost $170 million over the next five years, which will digitize all clinical information so that it will be available at 120 WellStar locations. “We believe WellStar Connect will improve quality and reduce the cost in services to the point where it will offset our initial investment,” says Budzinski.

The high cost of health care is most acutely seen in the emergency rooms across the country, where costly tests and hands-on expertise are available to anyone, regardless of their insurance status or ability to pay. Since WellStar Kennestone has the busiest emergency department in Georgia, the problem represents one of the biggest revenue drains on the health system. “We are ending the third year in a row where our uncompensated care tops out at more than $200 million,” says Budzinski. “The fact is, one out of every 10 patients our hospitals served are uninsured, and in our emergency room, one out of every three people is uninsured.”

The high cost of health care is most acutely seen in the emergency rooms across the country, where costly tests and hands-on expertise are available to anyone, regardless of their insurance status or ability to pay. Since WellStar Kennestone has the busiest emergency department in Georgia, the problem represents one of the biggest revenue drains on the health system. “We are ending the third year in a row where our uncompensated care tops out at more than $200 million,” says Budzinski. “The fact is, one out of every 10 patients our hospitals served are uninsured, and in our emergency room, one out of every three people is uninsured.”

With the adoption of the ACA and its focus on chronic disease prevention, primary care services and the overall expansion of both private and public insurance, the hope is that the cost of uninsured care will decrease dramatically. “Those individuals who designed the bill plan for these costs to go down significantly due to expanded Medicaid and other initiatives,” says Budzinski. “But the truth is, no one really knows yet, especially since Gov. Deal has rejected the Medicaid expansion due to possible cost increases to the state.”

Small Businesses and Senior Care

As baby boomers retire in droves, the once robust workforce will begin to strain Social Security, Medicare and Medicaid, institutions that already account for 41 percent of the federal budget. AmeriCare Georgia is one of many small businesses that have stepped up to serve the Atlanta region’s aging population with the help of 120 employees who provide companionship, housekeeping, medication monitoring, personal care, meal preparation and transportation to the elderly and disabled.

“The ACA had been on my radar for a long time, and it’s been a tough thing strategy-wise because of the Supreme Court case and the presidential election—it was difficult to know what would happen,” says Doug Lueder, owner and president of AmeriCare Georgia and the advocacy chair of the National Aging in Place Council. “But ultimately, regardless of the outcome, I want to provide health care for my employees, while still maintaining our superior care to clients at competitive prices.”

For small businesses, particularly service-based companies like AmeriCare Georgia, where employee payroll is the biggest cost of doing business, an insurance mandate can have a big effect on the bottom line. “I’m trying to utilize technology where I can to gain efficiency and save money where I can so that I can still provide insurance to a minimum of 50 percent of my employees while still not increasing my costs to clients.” Lueder cites small business tax credits as one of the ways he’ll be able to comply with the demands of the new law. “If I’m paying at least half of the health care costs for my employees, the government will pay for 35 percent of the cost, and grants are available to companies who want to start wellness plans.”

However, he notes that the bill still represents an increased cost to employers, and puts a strain on his ability to provide vital services to his already cash-strapped clients. “The economy has been tough on my clients,” he says. “Many of them are seniors who have seen their home values go down—it definitely forces employers to look at hiring strategies differently.” While Lueder says he aims to provide insurance for all his employees, many of his competitors are outsourcing their workers from staffing agencies to keep from reaching 50 full-time employees. “Staffing businesses are growing because it’s safer to use agencies and let them worry about meeting the insurance costs,” he adds.

Lueder believes one of the most positive provisions in the bill is the 2012 stipulation that expands state Medicaid roles by raising the ceiling of income to 133 percent of the poverty level, which would allow him to expand his business and serve more low-income individuals who need care. “That increase in individual household income will allow more individuals to have care, and being able to serve a larger population will be a huge plus, because right now there are a lot of people who make just a little too much to qualify for the care they need,” says Lueder, who notes that Gov. Deal’s rejection of Medicaid expansion due to the current $300 million budget shortfall puts the program at risk, and could prevent 650,000 previously uninsured Georgians from receiving coverage.

Controlling Costs

While the ACA is still in its infancy, and its full impact may not be felt for years, once all its provisions are in place, there is evidence that medical cost increases may be slowing. While premiums still rose this year, the average family experienced a modest 4 percent cost increase—a victory given that premiums have skyrocketed by 45 percent since 2006. However, some critics attribute this drop as evidence that recessionary workers and their families are seeking and receiving less care.

Despite the current fiscal uncertainty, the independent Congressional Budget Office calculated that the ACA would result in a $210 billion reduction in the deficit from 2012 to 2021. While nearly half of the provisions detailed in the ACA are designed to keep care affordable, one of the biggest ways to control cost is preventing insurance companies from spiking rates and ensuring they spend 80 percent of premium revenues on care instead of advertising or executive salaries.

Other cost control measures include fighting insurance and Medicare fraud, providing free preventive care to stave off costly chronic conditions and rebuilding the primary care workforce to prevent patients from seeking more costly emergency alternatives. Other focuses include improving efficiencies through digital records, encouraging integrated health systems, reducing paperwork and administrative costs, linking payments to quality outcomes, enacting taxes to promote individual responsibility and paying physicians based on value, not volume.

According to WellStar, one of the most exciting aspects of the new health care bill focuses on finding new strategies and innovative ways to create system-wide cost savings. “The ACA allows Medicare providers like WellStar to become an Accountable Care Organization (ACO), with the opportunity to manage an entire continuum of care for Medicare beneficiaries,” says Budzinski. “WellStar was one of the first to be selected and the goal of an ACO is to improve the quality of health care while bending the cost curve. We determined that out of 36,000 Medicare beneficiary lives assigned to us, 25 percent of those individuals incur 80 percent of the cost, so there is an opportunity to provide better integrated care to keep those patients healthy and out of emergency rooms and our hospitals.” Similar pilot programs across the country targeting the sickest, poorest and most underserved Medicare patients seem to show that great care can be cost efficient, especially when patients stay educated and in touch with their health so they can manage their chronic conditions, or work to prevent developing such conditions in the first place.

“Patients with chronic conditions like COPD, diabetes, heart disease and a handful of other conditions make up the most consistent patient core and present the greatest opportunity to have seamless care for these Medicare beneficiaries,” says Budzinski. “This program will allow us to continue our mission of improving care and this is just one of the opportunities that the ACA allows for in terms of bending the state and national cost curve. Without sacrificing quality, this year our cost per patient encounter adjusted for acuity was less than it was in 2008,” says Budzinski. WellStar’s success in controlling costs proves that despite an aging population, expensive emerging medical technology and ballooning lifestyle diseases, cost control in medicine might still be attainable.

The Future of Health Care

The Patient Protection and Affordable Care Act may represent one of the greatest expansions of consumer and patients rights—leveling the playing field for seniors, women and the sickest and poorest members of society. The provisions in the bill are designed to prevent some of the most heart-wrenching crises a family could face—a medically-induced bankruptcy, denying a child heart surgery because she has reached her lifetime insurance cap or being denied coverage for a previous incidence of cancer.

However, dramatic expansions of patient protections and consumer benefits come at a high cost—sometimes dramatic costs for small businesses that struggle to insure all their employees, doctors who must see more patients for less money, insurance companies facing regulations that could cripple their bottom line and health systems that struggle to maintain cost control and top-notch quality standards in a medical landscape innovating by leaps and bounds.

However, dramatic expansions of patient protections and consumer benefits come at a high cost—sometimes dramatic costs for small businesses that struggle to insure all their employees, doctors who must see more patients for less money, insurance companies facing regulations that could cripple their bottom line and health systems that struggle to maintain cost control and top-notch quality standards in a medical landscape innovating by leaps and bounds.

While many of the ACA’s provisions will benefit significant slices of the American population, it remains to be seen whether it, or anything, can curb the runaway cost of 21st century medicine. “There will be some positives and some negatives when you’re looking at the country as a whole,” says Zuckerman. “There will be more people in the system with insurance, and more alignments and incentives between hospitals, doctors and vendors, but the negatives will be more volume in the face of a doctor shortage and more dollars spent on bureaucracy instead of patient care.”

For Lueder, the act represents many upfront challenges, followed by a revolution in how Americans—one of the sickest populations in the developed world—view their own personal health choices and outcomes. “In the short term there will be big costs involved, but if we’re talking long term, I think it will be positive in terms of promoting health care and wellness,” says Lueder. “People will get sick less and companies will be more productive because absentee rates will be lower. People will no longer lose their homes due to medical costs and there will be long-term fiscal benefits because people will be healthier.”

In light of all the uncertainty yet to come in a rapidly changing medical landscape that just two generations ago had never heard of gene therapies, heart transplants or robotic surgery, perhaps WellStar’s Budzinski says it best: “It’s difficult to figure out the future until it starts to unfold in front of us, but we are preparing for it nonetheless,” he says. “In 2014 we’ll start to experience the insurance exchanges and Medicaid expansion, but our job is not to promulgate policy. Our goals haven’t changed. We’re still trying to deliver great quality care, improve our productivity and be efficient and good stewards of the community assets we have been entrusted with.”

In September/October, we featured an article about the implementation and effects of two new pilot programs in Cobb County schools – Bring Your Own Device (BYOD) and flipped classrooms. At the time the article was written, three Cobb County middle schools had launched the program. Since then, the number of participants has grown due to positive response from both teachers and students—BYOD has increased to 104 participants, while flipped classrooms have jumped to 27. Teachers and students are reported to be excited about the new programs.

In September/October, we featured an article about the implementation and effects of two new pilot programs in Cobb County schools – Bring Your Own Device (BYOD) and flipped classrooms. At the time the article was written, three Cobb County middle schools had launched the program. Since then, the number of participants has grown due to positive response from both teachers and students—BYOD has increased to 104 participants, while flipped classrooms have jumped to 27. Teachers and students are reported to be excited about the new programs.

Merchant’s Walk and its retailers are hosting the Holiday Walk on Thursday, December 6, 2012 from 6pm to 9pm. The annual Holiday tree lighting and celebration will feature live Holiday tunes performed by the Pope High School Band and the Walton High School Women’s Choral Ensemble, as well as an appearance by Jolly St. Nick who will be on hand to light the tree for the season and for photos. To express gratitude to the community for their continued support of Merchant’s Walk and its shops, guests will enjoy complimentary hot cocoa and gift bags filled with Holiday discounts and giveaways. Merchant’s Walk retailers will also provide complimentary refreshments and in-store savings exclusive to Holiday Walk guests.

Merchant’s Walk and its retailers are hosting the Holiday Walk on Thursday, December 6, 2012 from 6pm to 9pm. The annual Holiday tree lighting and celebration will feature live Holiday tunes performed by the Pope High School Band and the Walton High School Women’s Choral Ensemble, as well as an appearance by Jolly St. Nick who will be on hand to light the tree for the season and for photos. To express gratitude to the community for their continued support of Merchant’s Walk and its shops, guests will enjoy complimentary hot cocoa and gift bags filled with Holiday discounts and giveaways. Merchant’s Walk retailers will also provide complimentary refreshments and in-store savings exclusive to Holiday Walk guests.

The high cost of health care is most acutely seen in the emergency rooms across the country, where costly tests and hands-on expertise are available to anyone, regardless of their insurance status or ability to pay. Since WellStar Kennestone has the busiest emergency department in Georgia, the problem represents one of the biggest revenue drains on the health system. “We are ending the third year in a row where our uncompensated care tops out at more than $200 million,” says Budzinski. “The fact is, one out of every 10 patients our hospitals served are uninsured, and in our emergency room, one out of every three people is uninsured.”

The high cost of health care is most acutely seen in the emergency rooms across the country, where costly tests and hands-on expertise are available to anyone, regardless of their insurance status or ability to pay. Since WellStar Kennestone has the busiest emergency department in Georgia, the problem represents one of the biggest revenue drains on the health system. “We are ending the third year in a row where our uncompensated care tops out at more than $200 million,” says Budzinski. “The fact is, one out of every 10 patients our hospitals served are uninsured, and in our emergency room, one out of every three people is uninsured.” However, dramatic expansions of patient protections and consumer benefits come at a high cost—sometimes dramatic costs for small businesses that struggle to insure all their employees, doctors who must see more patients for less money, insurance companies facing regulations that could cripple their bottom line and health systems that struggle to maintain cost control and top-notch quality standards in a medical landscape innovating by leaps and bounds.

However, dramatic expansions of patient protections and consumer benefits come at a high cost—sometimes dramatic costs for small businesses that struggle to insure all their employees, doctors who must see more patients for less money, insurance companies facing regulations that could cripple their bottom line and health systems that struggle to maintain cost control and top-notch quality standards in a medical landscape innovating by leaps and bounds.